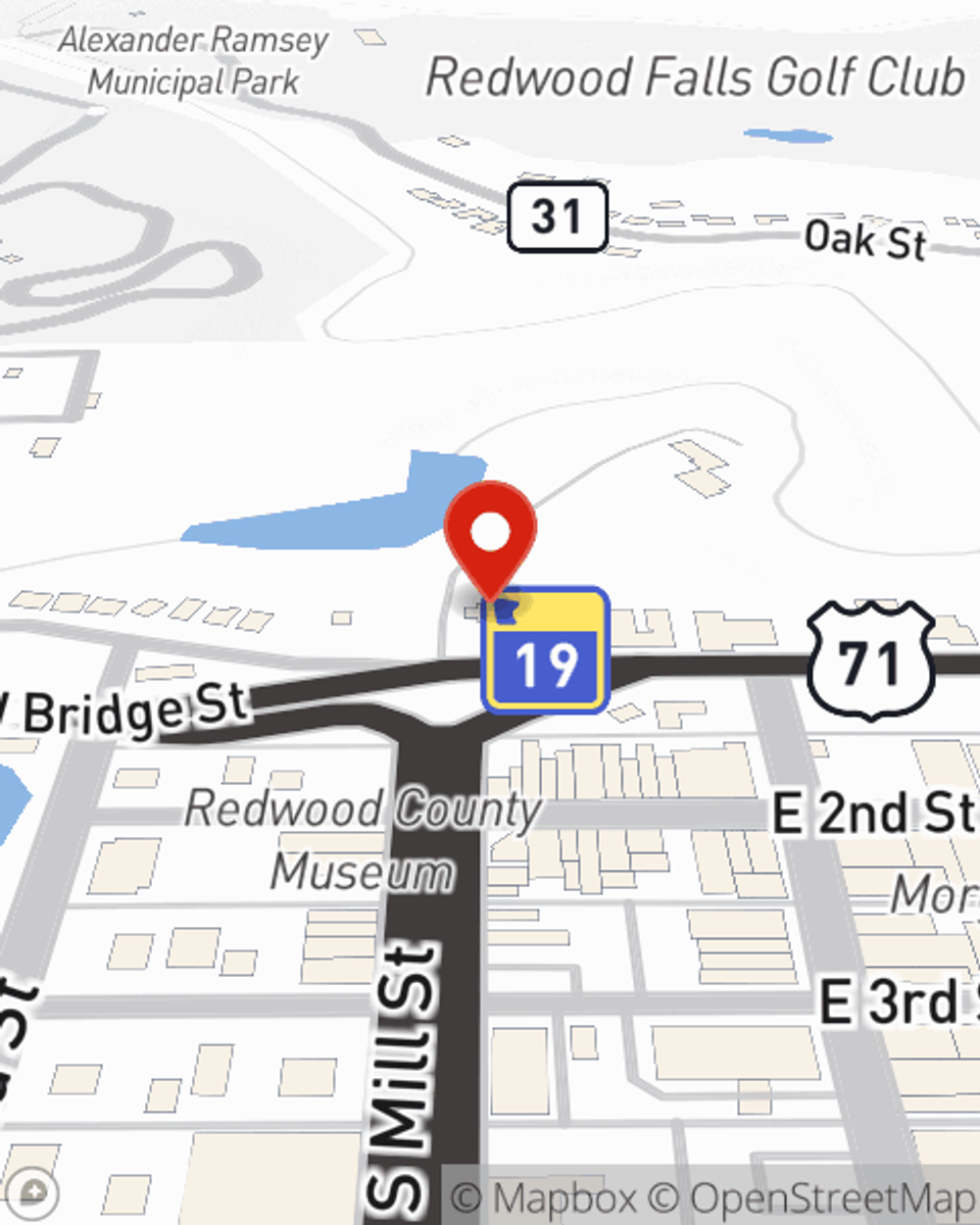

Homeowners Insurance in and around Redwood Falls

A good neighbor helps you insure your home with State Farm.

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

There’s No Place Like Home

New home. New memories. State Farm homeowners insurance. They go hand in hand. And not only can State Farm help insure your home in case of blizzard or hailstorm, but it can also be beneficial in certain legal cases. If someone were to hold you financially accountable if they tripped on your property, the right homeowners insurance may be able to cover the cost.

A good neighbor helps you insure your home with State Farm.

Help protect your home with the right insurance for you.

State Farm Can Cover Your Home, Too

With this terrific coverage, no wonder more homeowners choose State Farm as their home insurance company over any other insurer. Agent Ryan Esse would love to help you choose the right level of coverage, just visit them to get started.

There's nothing better than a clean house and protection with State Farm that is commited and value-driven. Make sure your valuables are insured by contacting Ryan Esse today!

Have More Questions About Homeowners Insurance?

Call Ryan at (507) 637-0014 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Which emergency backup generator is right for you?

Which emergency backup generator is right for you?

A backup generator can help during a blackout. These tips on permanent and portable generators can help you choose.

How much to budget for home maintenance

How much to budget for home maintenance

Understanding the lifespan of a house and how much to budget for home maintenance can help you be more prepared when it’s time for those costly repairs.

Simple Insights®

Which emergency backup generator is right for you?

Which emergency backup generator is right for you?

A backup generator can help during a blackout. These tips on permanent and portable generators can help you choose.

How much to budget for home maintenance

How much to budget for home maintenance

Understanding the lifespan of a house and how much to budget for home maintenance can help you be more prepared when it’s time for those costly repairs.